Channel Discounts vs. Margins: A Comprehensive Guide for Maximizing Profitability

- Anonymous Channel Manager

- Jul 28, 2024

- 4 min read

It’s time to clear up one of the biggest mistakes sellers make when calculating discounts and margins. For as long as channels have been around, OEM sales reps have been using these interchangeably and as a result, giving away revenue. In this post, we'll explore the basics of channel margin, discounts, markup, and cost of goods sold (COGs). Combined with channel budget drops organizations are suggesting in 2024 albeit the increase OEM dependency on partners for cost-containment and productivity, getting "Margins" vs. "Discounts" correct is important. As your company grows, ensuring understanding across reps, systems, and overall pricing strategies can make a significant difference in growth. The better the business understands ‘channel margin’ and discount/pricing strategies the better the business will be able to evaluate the effectiveness and profitability of different sales channels and make informed decisions about channel strategy and resource allocation.

Channel Discounts

Channel discounts are price reductions offered to channel partners, such as distributors, resellers, or marketplaces, to incentivize them to sell a company's products or services. These discounts are designed to make the products more attractive and competitive in the market, encouraging channel partners to prioritize them over competitors' offerings. Channel discounts can take various forms, such as:

Volume Discounts: Reduced prices based on the quantity of products purchased.

Promotional Discounts: Temporary price reductions during specific promotional periods.

Tiered Discounts: Different discount levels based on the partner's sales performance or status in the channel program.

Channel discounts directly impact the price at which channel partners purchase the product from the company. The product price has more to do with the margin recognized by the partner than the discount rate. Always has. Always will. Front-end discounts matter a lot to partners as part of their sales process. The discount gives them room to negotiate prices with their customers, but it doesn’t necessarily influence their overall profitability. For that, we must turn to “channel margins”. Let’s take a deeper dive there.

Channel Margin

Channel margin represents the profitability of selling a product or service through a particular sales channel. It is the difference between the revenue generated from sales through the channel and the costs associated with that channel. Channel margin includes all expenses related to distributing, marketing, and supporting the product within the channel, such as:

Commissions

Incentives

Marketing expenses

Training costs

Any other direct expenses associated with the channel

Channel margin provides a measure of how profitable a channel is after accounting for all the associated costs.

Key Differences

Purpose: Channel discounts are used to incentivize channel partners to sell a product, while channel margin measures the profitability of using a particular sales channel.

Calculation: Channel discounts are subtracted from the product's price to determine the cost for channel partners. Channel margin is calculated by subtracting channel costs from the price that the end-user/customer pays for the same services.

Impact on Pricing: Channel discounts affect the price at which channel partners purchase the product. Channel margin affects the overall profitability of the sales channel for the company.

Understanding both concepts is crucial for effective channel management, pricing strategies, and ensuring that sales channels contribute positively to the company's bottom line. Many times, OEMs get caught up in what the discount is not realizing that the margins might be far less than what the reseller, or more specifically the reseller rep, needs in order to make your product interesting. This is not to suggest that margins is the ONLY thing that drives behavior, but it’s a significant factor given this is how they retire quota.

Let’s walk through some examples:

Consider this: Discounts are contextual. You offer partners 20% off the reference price (MSRP). One competitor offers 25%, and a third offers 40%. It seems unequal, right? And the vendor with 40% has the advantage in attracting and engaging with partners.

But now let’s look at the math to see how these discounts play out in the “real world.”

Everyone is equal in terms of gross margin to the partner relative to their respective reference price. Now, let’s make the discounts equal.

Clearly the product price has more to do with the margin recognized by the partner than the discount rate; assuming that the customer pays MSRP. Now let's take a look at how most deals might look and where OEMs tend to make mistakes.

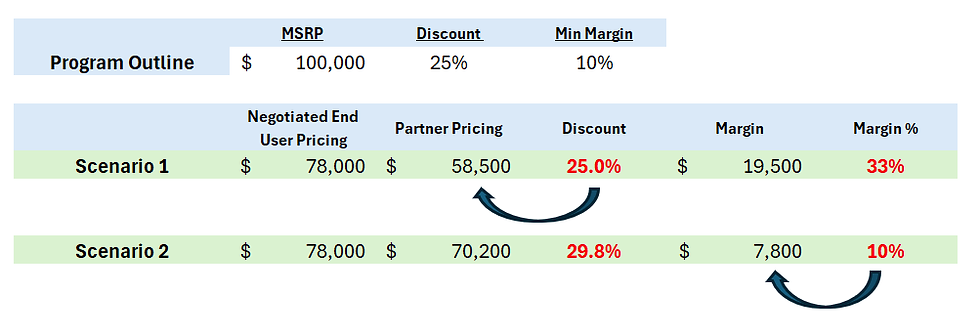

Let's assume your channel program calls for a 25% discount for partners on deal registration. Most of your sellers today will assume that the partner will earn 25 points from whatever is negotiated with the end user. Don't believe me? Go ask your sellers to run you through the last channel deal they did. 80% or greater will provide discount this incorrectly vs. understanding that the partner works off a margin % that should be factored from the price to the end user. Sure, they can earn higher if they're selling at list price; however, most deals aren't happening at list across most organizations today. Discounting across enterprise software companies was averaging ~ 40% in 2023 for example.

In scenario 1, the seller is "discounting" 25% from the negotiated end user price. Clearly wrong and as a result you vendor will take a higher discount than necessary and the partner will actually make higher margin than required to transact the deal.

In scenario 2, the seller has discounted properly (from MSRP) and also provided the partner with their required 10% margins. The delta to the company is clearly significant.

Understanding the difference between discounts and margins is crucial for sales teams working with channel partners because it enables them to manage profitability, theirs and your channel, effectively. By comprehending how discounts impact margins, and architecting this into your quoting tools, sales teams can develop pricing strategies that attract partners while safeguarding your organization's profits. This knowledge allows them to create incentive programs that drive sales without eroding financial goals, allocate resources efficiently to the most profitable channels, and negotiate better terms with partners. Ultimately, this understanding helps optimize channel relationships, ensuring long-term sales growth and healthy profit margins.

Comments